关于我们

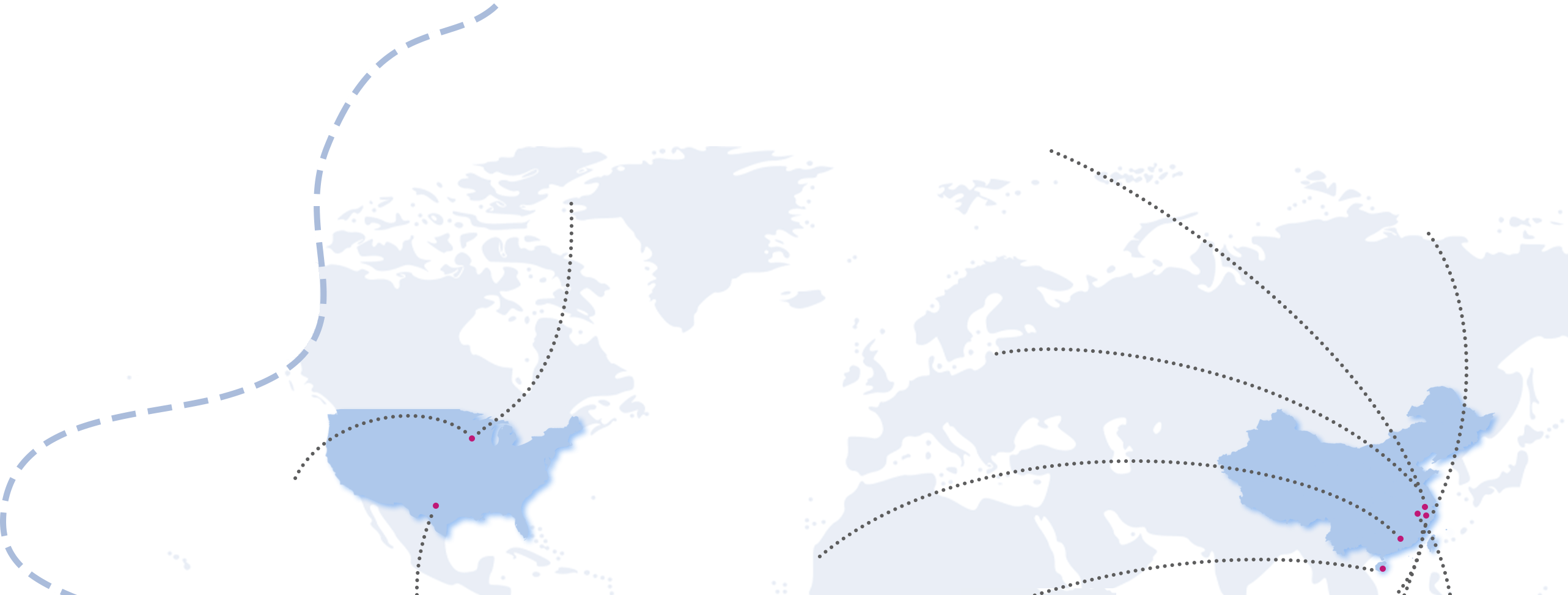

康迪科技集团是在美国纳斯达克主板上市的企业集团。在各级领导的关怀和支持下,已发展成为集研发、生产、销售为一体的现代化企业。在浙江金华设有浙江康迪科技集团有限公司、浙江康迪智能换电科技有限公司、金华市康迪新能源车辆有限公司,在浙江永康设有永康市斯科若电器有限公司,在浙江杭州设有康迪科技集团研究中心、中换电(浙江)科技有限公司,在江西新余设有江西省汇亿新能源有限公司,在海南海口设有康迪电动汽车(海南)有限公司,在美国德克萨斯州达拉斯和内华达州设有SC Autosports,LLC、Kandi America Investment, LLC和Kandi Electric Innovation, Inc.